iowa homestead tax credit calculator

This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the. Applicants must own and.

States Cut Taxes For Income Gas Property And Groceries Money

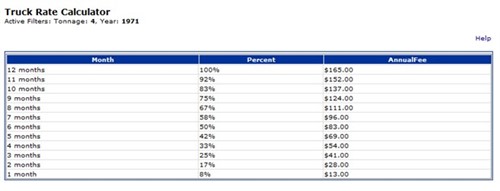

How do I estimate the net tax for a residential property with Homestead and Military Tax Credit.

. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The current credit is equal to the actual tax levy on the first 4850 of actual value. Application for Homestead Tax Credit IDR 54.

In 2021 the Iowa legislature passed SF 619. Equals 100 Actual Value multiplied by the appropriate. Ad Get Reliable Answers to Tax Questions Online.

Equals the net taxable value divided by 1000 multiplied by the tax levy rate and rounded to the nearest cent. The homestead credit is a tax credit funded by the state of iowa for qualifying homeowners and is based on the first 4850 of net taxable value. 52240 The Homestead Credit is available to all homeowners who own and occupy the.

701801425 Homestead tax credit. Change or Cancel a Permit. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Track or File Rent Reimbursement.

913 S Dubuque St. Iowa City Assessor. For most taxpayers the Homestead Credit equals 4850 divided by 1000.

Iowa Homestead Tax Credit Calculator. Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa. Register for a Permit.

Guaranteed maximum tax refund. Certified Public Accountants are Ready Now. How much is the homestead tax credit in Iowa.

Property owners must sign with the City or County Assessor and qualify under standards set by the State of Iowa. Homestead Tax Credit To qualify for the credit the property owner must be a resident of Iowa and occupy the property on July 1 and for at least six months every year. The Military Tax Credit is an exemption intended to provide tax.

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. The homestead credit is. No homestead tax credit shall be allowed unless the first application for homestead tax credit is.

Ad Free tax filing for simple and complex returns. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. The property owner must.

As with the Homestead Tax Credit the exemption remains in effect until the. Division 28 of that bill expanded eligibility for the property tax credit under Iowa Code chapter 425 subchapter II based on. Max refund is guaranteed and 100 accurate.

Free means free and IRS e-file is included. To qualify for the credit the property owner must be a resident of Iowa and occupy the property on July 1 and for at least six months of every year. 8011 Application for credit.

For additional information and for a copy of the application please. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. Homeowners may qualify and sign for a Homestead Exemption with the city or county assessor.

Discover Helpful Information And Resources On Taxes From AARP.

What The Property Tax Deduction Cap Could Mean For Taxes Credit Karma

Tax Calculator Scott County Iowa

Eligibility Expanded For Elderly Property Tax Credit For Those Aged 70 Polk County Iowa

Choose The Best Texas Property Tax Loan Provider Federal Lawyer

Kansas Tax Relief Program Will Be Available Soon But Too Late For Some Businesses Kiowa County Press Eads Colorado Newspaper

Sales Tax Calculator Credit Karma

Tax Facts For People With Disabilities Iowa Compass

Colorado Sales Tax Rate Rates Calculator Avalara

How Taxes On Property Owned In Another State Work For 2022

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Calculating Property Taxes Iowa Tax And Tags

Homeowners Are You Missing Exemptions On Your Property Tax Bills Cook County Assessor S Office

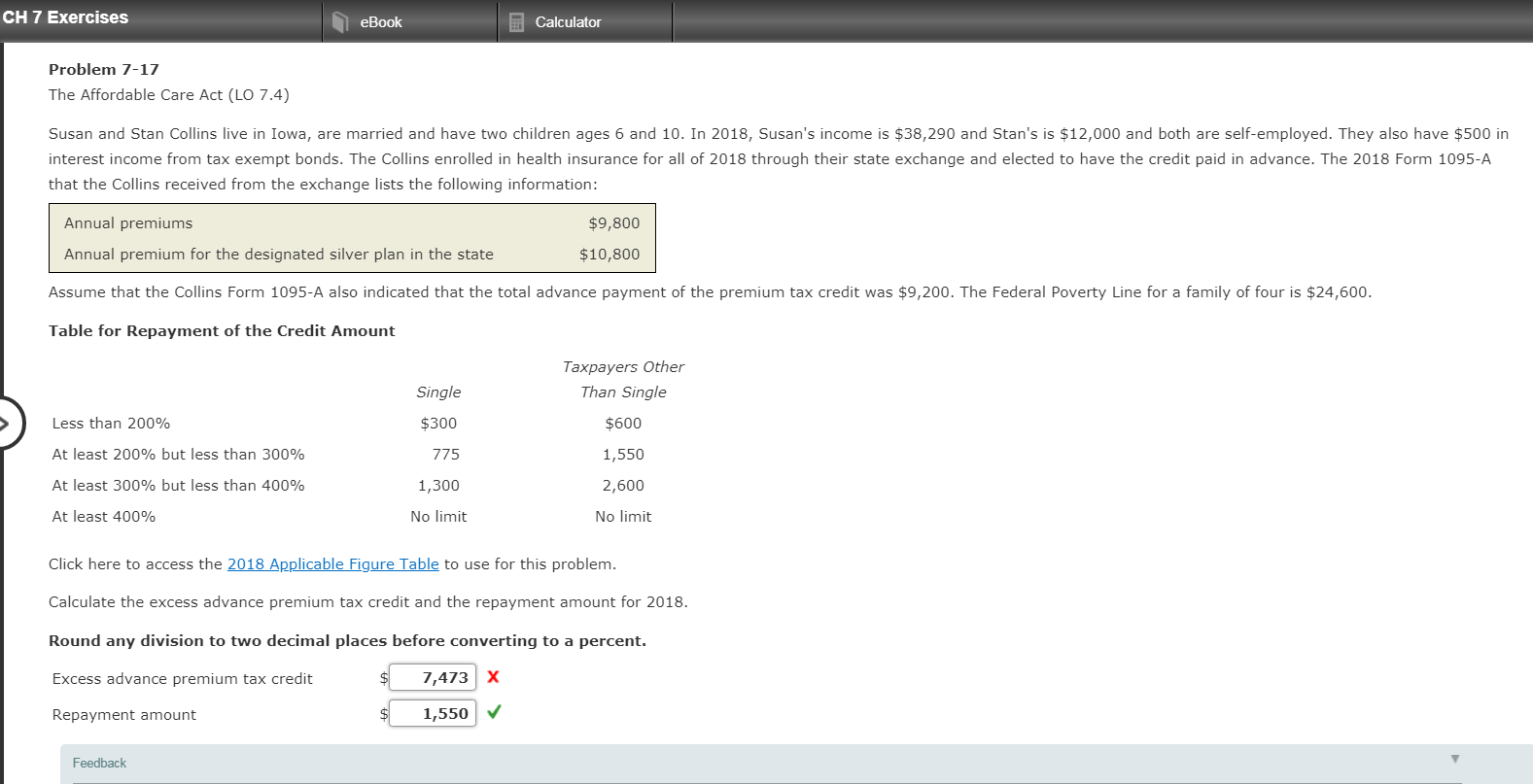

Ch 7 Exercises Ebook Calculator Problem 7 17 The Chegg Com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax